FHA’s Energy efficient Home loan system allows people to save cash into the their bills by offering help incorporate energy savings keeps so you’re able to this new or more mature home as part of an enthusiastic FHA-covered household. EEM applications give home loan insurance coverage for a person to get otherwise refinance a property and can include the cost of energy efficient improvements. New resource is inspired by a lender like a lender, company otherwise deals and you may mortgage organization, nevertheless financial is still insured by HUD.

Professor Next door System

HUD composed which advice getting instructors to shop for residential property in reasonable so you’re able to average income elements. The application was specifically for coaches who do work regular within the public colleges personal schools, but they also can operate in government, condition, county otherwise city informative agencies. The newest teacher provides feel official by the condition and you will teach-in a classroom, or you can end up being a manager during the levels K thru 12. You additionally have to be in a beneficial updates with your company so you’re able to be considered, and thus new employer need to approve which you works full date as the an instructor or officer. With this specific program, it’s not necessary to end up being a first-date family buyer, you can’t individual every other home at the time you close on the the property.

Searching for State government Applications

You can find special apps applied because of the state and you will local homes loans administrations. You might name neighborhood authorities homes place of work or go to and appearance to have programs on your own state. Most of the area keeps different recommendations to possess first-time homebuyers and advance payment guidance.

Non-Money Apps for Casing

There are a number of non-funds teams that where can i get an itin loan in Boykin work with HUD so you’re able to help somebody manage another domestic. You need this new non-profit browse and find a summary of organizations towards you which will help. All these groups is actually listed of the county. They supply financial assistance, advice and also agent properties.

Habitat to own Humanity Software

The newest non-profit organization Environment having Humanity is famous if you are an excellent nondenominational Religious construction company you to places lower income members of top quality residential property. You will find usually three parallels so you can qualities anticipate having Environment to have Humanities.

- Domiciles are sold from the a no earnings without attention energized to the financial.

- Homebuyers and volunteers build our home while significantly less than top-notch oversight.

- Enterprises, small enterprises, some one and you may believe teams collaborate to incorporate help.

Home buyers are usually chosen from the the you prefer and you can capacity to pay off the fresh new no-money, no-desire home loan. They might also have to volunteer or focus on Habitat to possess Humanity. The average costs for those residential property are $fifty,one hundred thousand to help you $70,000. Home loan lengths along with is generally only seven many years however, increase so you can 3 decades.

Generate an offer

Once you’ve felt most of the you’ll risks, evaluated your revenue, planned a funds and you may checked out the housing market in which you should alive, you will have wise if or not you are able to an bring or not. Need the capability to generate current and you may future money, that comes as a result of fitness, money and you may employment security. You also need financing to cover the an advance payment, initial swinging will set you back and you can offers. When you have a number of expense, you can shell out such down prior to trying to order a property.

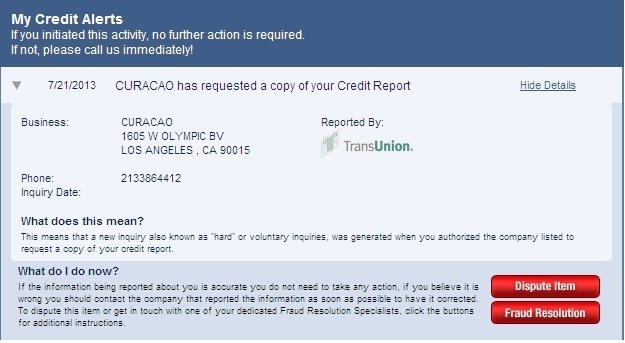

Before making a deal, you could potentially head to a loan provider and speak about pre-acceptance to see exactly what amount youre working with. Discover an excellent pre-recognition, you’ll want to understand what’s on your credit file and you can confirm you could build big down-payment, or you have to be accepted having a good HUD loan. When you are happy to generate a deal, you are able to indication a purchase agreement, together with financial will have your house appraised because of its market really worth. A connection page often outline this new terms of your home acceptance if for example the house is inspected and you can appraised as the beneficial by your bank.

Comments are closed