If you like more cash however, need the flexibility to make use of it when you require they, a line of credit was beneficial. Consider it instance a credit card which have a tap’. Just after recognized, you could invest as much as one limitation. Its best for men and women home improvement systems you’ve been eyeing or when lifestyle sets an urgent bill your path.

What exactly is A credit line?

A credit line (LOC) otherwise credit line is a type of versatile financing. A financial approves your having an optimum borrowing limit (e.g., S$10,000). You could use any amount up to that limitation.

You will simply pay desire on which you utilize. For example, for people who acquire S$2,000, you pay focus thereon count, not the whole S$10,000 maximum.

Playing cards are a form of line of credit. If you spend their card balance entirely every month, you end attention charge.

not, in the place of unsecured loans, credit lines lack fixed cost symptoms, as well as their interest rates changes. They frequently provides annual fees unlike an initial control percentage.

Advantages of Line of credit

- On-Demand Borrowing from the bank: Instead of traditional financing, you don’t discovered a lump sum payment up front. Alternatively https://availableloan.net/installment-loans-co/, you could potentially just availableness loans as required, to their acknowledged borrowing limit. It indicates you’re not paying interest into the currency you have not yet , put.

- Rotating Borrowing from the bank: Because you repay exactly what you have borrowed, one to count gets readily available once again. This is going to make a LOC ideal for constant expenses or motion in your cash circulate.

- Probably Bring down any costs: Credit lines normally have straight down rates of interest than playing cards. If you’re holding large-attention debt, a beneficial LOC might be a simple way so you can combine and you can help save money on focus fees.

- Right for Emergencies: Unforeseen will cost you happen, and LOC will bring a monetary cushion to possess sets from car repairs so you can medical expense, providing you comfort and time for you to get well economically.

Exactly what are Sort of Personal line of credit

A credit line (LOC) provides flexible the means to access financing when you require them. Let’s mention the most popular solutions.

Credit line

A credit line provides flexible accessibility unsecured borrowing from the bank. You could potentially obtain to their limitation, repay what you utilized, and obtain again as needed. In order to meet the requirements, you can usually you prefer higher level borrowing from the bank (670+ score, zero non-payments) and you will a reliable money. Deals or security such as for instance Dvds can also be improve your odds, but they commonly usually required.

- Versatile financing getting tenants and you can non-homeowners and no equity expected.

- Spend less that have all the way down interest rates than simply very credit cards.

- Deal with emergencies effortlessly thanks to quick earnings.

- Unsecured personal LOCs usually costs highest rates of interest than protected alternatives. Your credit rating heavily affects their speed, thus people who have straight down score pays a whole lot more.

- Because they do not you desire collateral, unsecured personal LOCs has actually more strict acceptance criteria. This can make sure they are hard to qualify for if you have a reduced-than-ideal credit score.

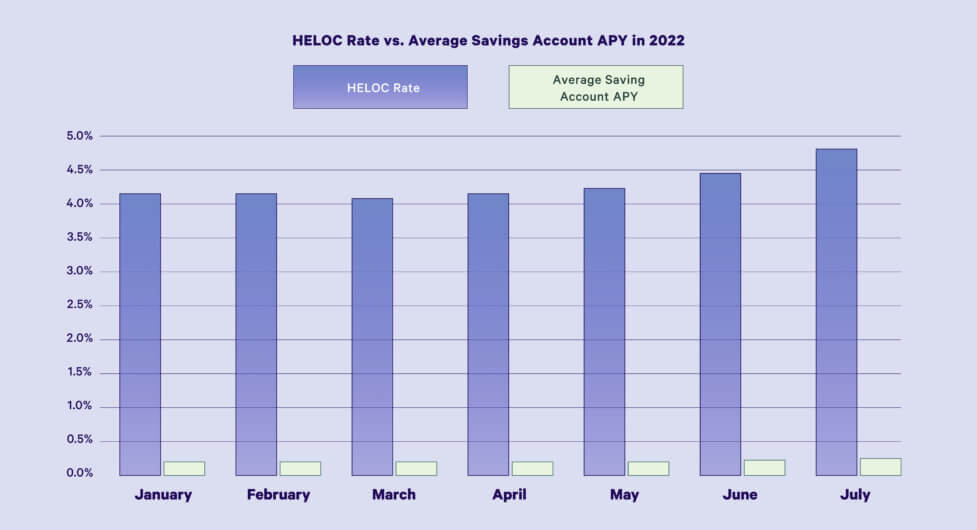

Domestic Guarantee Credit line

Consider a home Equity Personal line of credit (HELOC) while the property-backed credit card. Your figure out how much security you really have (your house’s value without what you owe on the home loan), plus the lender set a credit limit according to you to definitely. For a while (always 10 years), you need to use the newest HELOC, pay they off, and employ it once more. At the end of that period, you’ll want to pay back whatever’s leftover.

- Flexible certification: Even after the average credit score, you could potentially qualify for good HELOC if you have adequate home equity.

Comments are closed