A storyline financing, in addition to recognized as a land mortgage, try specifically made for folks looking to purchase an item of house otherwise patch for building a property. Rather than normal mortgage brokers that are availed to acquire constructed functions, a plot financing is actually availed to find a vacant spot in place of people mainly based-up construction. Spot fund have their number of conditions, like the area financing rate of interest, that may range between the fresh costs offered into home loans.

Getting a storyline Loan?

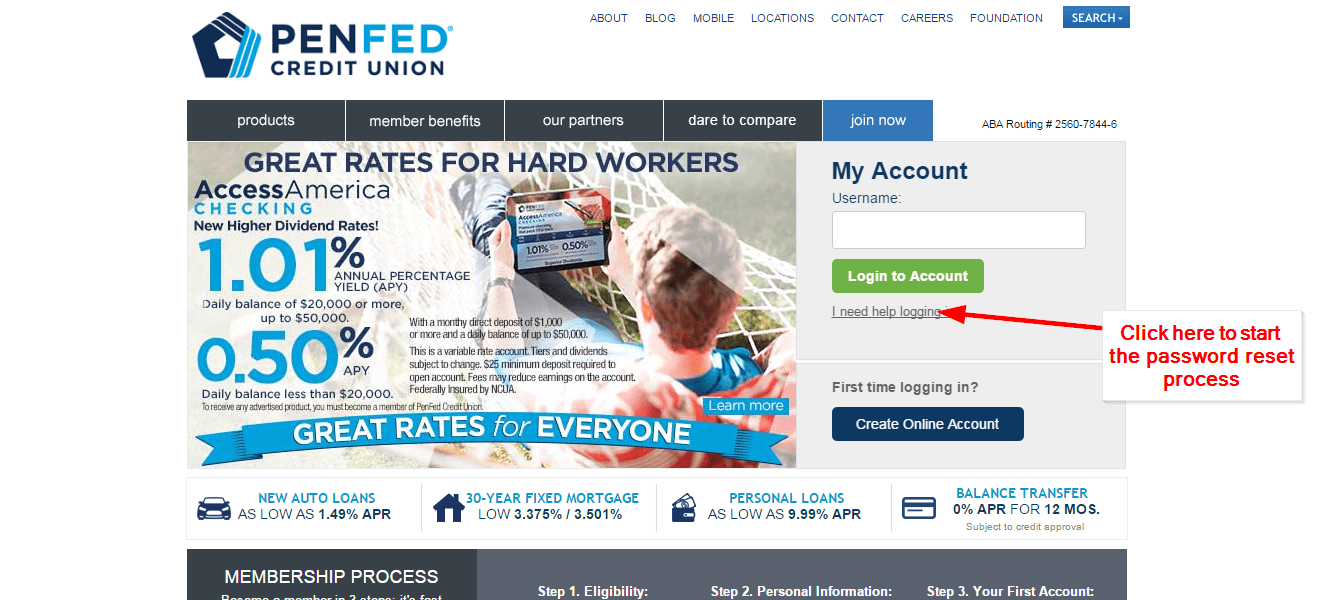

The method so you’re able to safe that loan to possess spot buy relates to multiple steps, you start with researching an educated area financing interest. Potential individuals is contrast individuals loan providers according to the costs considering, installment terms and conditions, and additional charge. Next, you have to submit an application function and you can fill out it together with the called for files to possess a storyline mortgage. The lending company will then run an intensive verification of the data files and you will gauge the applicant’s qualifications in advance of sanctioning the loan. You will need to keep in mind that the patch financing procedure might some change from you to definitely lender to a different but essentially observe this framework.

Is there a big change Anywhere between Mortgage, Patch Mortgage, and you can Home Financing?

Yes, discover a basic difference in this type of financing. Mortgage brokers are meant for to order already developed features, while to acquire plots of land in the Chennai, belongings financing come that’s unlike the home loans. An important distinctions sit within their mission, eligibility requirements, plot financing rates, and you can taxation positives, so it’s vital to understand such distinctions before you apply.

Securing a storyline structure loan offers many perks, such as the independence to build your property as per your preferences and you may timelines. Such fund along with often function aggressive plot financing rates of interest, which makes them an appealing option for of several. At the same time, investing in a land, particularly in desired-immediately following towns for example plots inside Madhavaram, normally give large productivity throughout the years on account of appreciating property philosophy.

What’s the Mortgage Eligibility Criteria for buying Plots of land?

Qualifications for a financial loan for plot buy relies on a slew out of affairs, close new applicant’s income profile, age group, latest a career state, in addition to their credit score condition. On top of that, the advantages of the area itself, including their geographic location, size, in addition to legality of its standing, gamble pivotal spots about loan’s approval techniques. Its vital to recognize that this requirements for qualifications can be diverge most certainly one of additional lending associations.

Do you know the Home loan Techniques?

Applying for a plot construction financing was a methodical procedure that evaluates debt qualifications and property you’re interested in buying so that the passion regarding the financial and you may borrower are protected. Very first, you’ll want to fill out an application form, providing detailed information about your financial, personal, and you can a career background. This is the step-by-step homes financing procedure.

Application for the loan -> Start with filling out the borrowed funds application provided with the fresh new financial. This form gathers your, monetary, and you will a position information.

File Distribution -> Submit the required files needed for the mortgage having plot get, and this generally were identity facts, address proof, income proof, and property documents.

Property Confirmation and you will Courtroom Evaluate-> The lending company confirms the property’s courtroom documents, performing a title look at, and you will appraising the property’s market price.

Mortgage Acceptance/Getting rejected -> According to research by the investigations of financial balance and the property’s valuation, the lender chooses to possibly accept otherwise deny the loan app.

Approve Letter -> In the event that approved, you get a great sanction letter claiming the borrowed funds amount, period, rate of interest, or any other small print of one’s financing.

Mortgage Agreement Signing-> You will want to indication the borrowed funds arrangement, that’s a lawfully joining document detailing the loan’s terminology and you may requirements.

Payment Starts-> Adopting the financing was disbursed, you start settling the mortgage courtesy EMIs (Equated Monthly premiums) as per the consented plan.

Which are the Data You’ll need for Applying for home financing?

Individuals records to own area financing enhance the lender to confirm the term, determine debt stability, and ensure the fresh legality of the home you need to get or make through to. All of the banking companies commonly ask for a common group of data files according to the fundamental guidelines.

We have found a summary of the quintessential data files you generally you need when applying for a home loan or area framework loan

Income Research: This may involve your paycheck glides for the last 3-half a year, taxation efficiency during the last dos-36 months, and family savings statements for the past half a year. For self-working anyone, this may include profit-and-loss comments, and organization continuity proofs.

Work Confirmation Facts: A letter out of your employer or a position offer for salaried someone, and you can company subscription documents to have mind-operating people.

Assets Data: Courtroom paperwork associated with the house or property, for instance the income deed, house term deeds, no-objection permits (NOCs) from related regulators, and recognized strengthening plans.

Proof of Downpayment: Research that you have the amount of money readily available for the newest advance payment, which is in the way of bank comments otherwise an excellent letter from the lender.

Credit report: However usually individually recorded from you, be equipped for the lending company so you can demand your credit score in order to evaluate your own creditworthiness.

Is there One Income tax Deduction for Home loans?

Yes, borrowers normally take advantage of income tax professionals on lenders around individuals chapters of the cash Income tax Operate. But not, it is critical to remember that the fresh income tax deductions to have area loans try minimal compared to the home loans, since they’re mostly structure. Benefiting from income tax deductions, you could potentially lower your taxable income of the claiming deductions towards the dominant payments of your house and you will spot finance. At exactly the same time, due to the fact design is done while entertain the house, transforming your own patch mortgage to the an everyday home loan enables an income tax reduction with the loan’s appeal piece, next cutting your nonexempt earnings.

End

A storyline financing is a wonderful monetary unit of these looking to find home having design intentions. Having aggressive patch loan rates therefore the potential for large yields to your investment during the portion, these types of loans bring a solid foundation for building your dream home. Knowing the area mortgage processes, qualifications conditions, and you will called for files can significantly simplicity new borrowing americash loans Vina experience, and come up with your trip into the managing a plot simpler and much more rewarding.

Comments are closed